US equity market ended on a positive note on Wednesday boosted by tech shares. The S&P 500 and Dow Jones industrial average closed at record highs, while the energy sector had the highest weight on market. The Dow Jones industrial average rose 12.75 points or 0.07% to close at 17827.69, the S&P 500 gained 5.76 points or 0.28% to close at 2072.79 and the NASDAQ Composite added 29.07 points or 0.61% to close at 4787.32. With half day trading session on Friday, market is expected to trade in a range with less volume.

STOCK SUMMARY:-

Conagra Foods Inc is overall in bullish trend and is sustaining at higher levels on chart. Traders can buy the stock above the level of $35.91 which is a near term resistance level for the stock, and if it manages to breach this level further bullish movement is expected in this stock to test the levels of $37.50.

CHART FORMATION

Stock is in bullish trend for near term and price is sustaining above trend line with good consolidation on daily intraday chart. Near term breach of resistance level of $35.91 is expected, which would trigger further bullish sentiment in the stock to test the levels of $37.50.

INDICATORS:-

RSI is trading with positive bias and is sustaining above the level of 50.

In MACD, signal line is sustaining above MACD line which is indicating bullish sentiment in the stock.

Recommendation

Buy above $35.91

Target

$37.50

BULLS

OF THE STREET (NYSE)

|

Name

|

Close

Price ( $ )

|

Change

%

|

|

UBS

Group Wi

|

23.20

|

32.70

|

|

American

Realty Investors

|

05.99

|

14.31

|

|

Veeva

Systems

|

32.43

|

12.45

|

|

E-House

Holdings ADS

|

09.89

|

09.71

|

|

China

Life Insurance ADS

|

52.37

|

09.26

|

BEARS

OF THE STREET (NYSE)

|

Name

|

Close

Price (

$ )

|

Change

%

|

|

Sea

drill

|

16.09

|

22.28

|

|

North

Atlantic Drilling

|

02.66

|

16.09

|

|

Diamond

Offshore Drilling

|

32.35

|

10.54

|

|

FMSA

Holdings

|

11.51

|

10.15

|

|

Fortuna

Silver Mines

|

04.51

|

07.96

|

CONAGRA

FOODS INC:

STOCK SUMMARY:-

Conagra Foods Inc is overall in bullish trend and is sustaining at higher levels on chart. Traders can buy the stock above the level of $35.91 which is a near term resistance level for the stock, and if it manages to breach this level further bullish movement is expected in this stock to test the levels of $37.50.

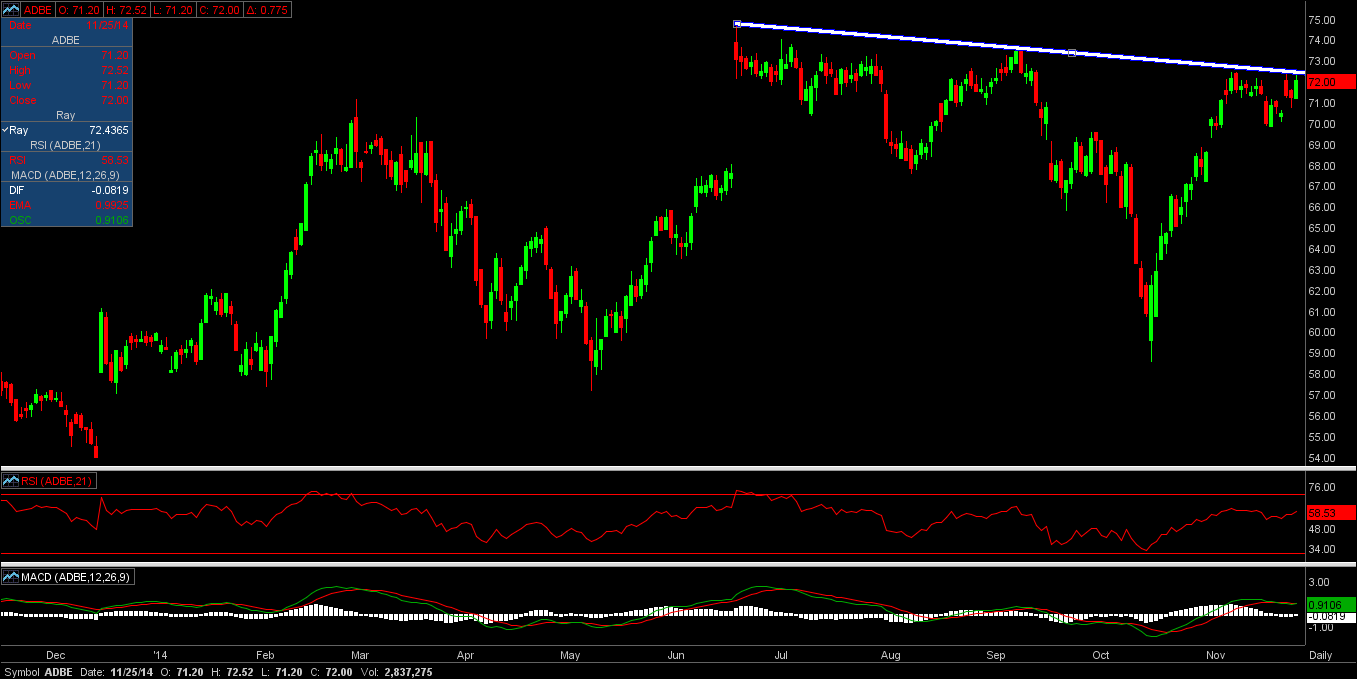

CHART FORMATION

Stock is in bullish trend for near term and price is sustaining above trend line with good consolidation on daily intraday chart. Near term breach of resistance level of $35.91 is expected, which would trigger further bullish sentiment in the stock to test the levels of $37.50.

INDICATORS:-

RSI is trading with positive bias and is sustaining above the level of 50.

In MACD, signal line is sustaining above MACD line which is indicating bullish sentiment in the stock.

- Activate Your Free Trial Now for #FOREX,#COMEX, #USA Stock Picks,#UK Stock Picks ,#HK Stock Picks.!!..Simply #Comment Your #Mobile Number and #E-Mail id Or Fill the Free trial Form Follow Link Here :-